|

Cassville Historical Society  Confederate Battle Flags on Confederate Graves from Paul Quillen on Vimeo. The only remaining pre-Civil War Cassville home: The Old Cassville Confederate Cemetery: The Old Cassville Post Office.

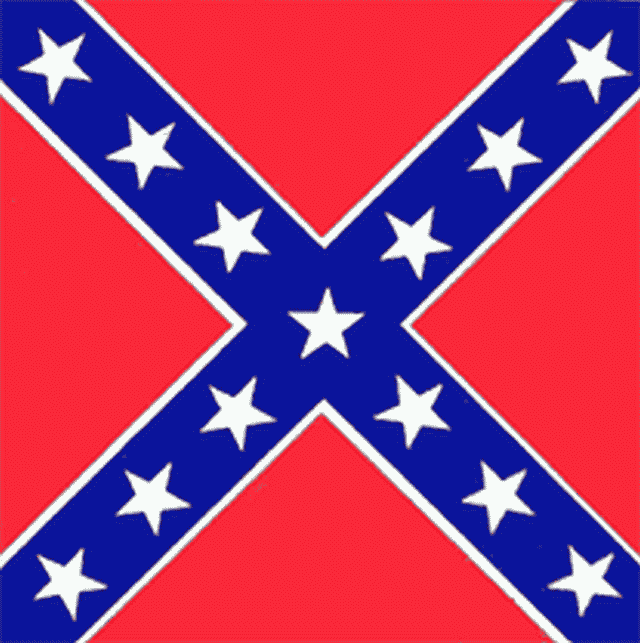

Formerly the Cassville Museum: The St. Andrews Cross. In the Civil War, it was known as the Confederate Battle Flag: Dedicated to preserving our proud Confederate States of America history and Cassville's history.

Dale Black, President Background music "Dixie" was composed by the poet Daniel Decatur Emmettd by the poet Daniel Decatur Emmett Domain registration and hosting by Emini Futures Day Trading Course |